Imagine this:

After years of building your MedSpa into a thriving business, the time has finally come to move on. Maybe you’re ready to retire. Maybe you want to start a new venture. Or maybe you’ve received an attractive offer.

But now you’re wondering… how do you actually sell your MedSpa?

Selling a MedSpa is very different from selling a traditional retail business. You’re not just selling equipment — you’re selling client relationships, brand reputation, future earnings, and a trusted place in the community.

In this article, we’ll walk you through the step-by-step process of selling a MedSpa the right way — so you can maximize your return and make the process as smooth as possible.

Why Planning Ahead Is Key

Many MedSpa owners wait too long to prepare for a sale — and leave money on the table. With the right preparation, you can:

✅ Increase your valuation before listing

✅ Attract better buyers

✅ Avoid legal headaches

✅ Negotiate a better deal

Buyers today are looking for well-run, profitable businesses with strong retention and predictable revenue. The more you can present your MedSpa as a “turnkey” operation, the higher your sale price will be.

In this guide, you’ll learn:

- How to prepare your MedSpa for sale

- How to accurately value your business

- Where to find the right buyers

- What to expect when negotiating and closing the deal

Let’s get started! 🚀

📝 Preparing Your MedSpa for Sale

Before you list your MedSpa, you need to prepare the business for sale — just like you’d stage a home before putting it on the market.

The goal is to make your business as attractive, organized, and “buyer-ready” as possible.

Key Areas to Prepare

📊 1️⃣ Financial Cleanup

Buyers want to see clean, clear financial records.

- Profit & loss statements (3 years minimum)

- Balance sheets

- Tax returns

- Revenue breakdowns (by service type)

- Client retention metrics

- EBITDA calculations

Tip: Hire a CPA to help you prepare professional financial statements — this builds trust and justifies your asking price.

⚙️ 2️⃣ Operational Improvements

Smooth operations = higher value. Buyers love “turnkey” businesses.

✅ Document key processes (opening, closing, client intake, etc.)

✅ Ensure staff are trained and reliable

✅ Fix any maintenance issues

✅ Update technology (POS, CRM, website)

📄 3️⃣ Legal and Compliance Prep

Don’t let small legal issues derail your sale!

✅ Check licenses and permits

✅ Ensure compliance with HIPAA and local regulations

✅ Review lease terms (if renting space)

✅ Address any outstanding legal disputes or risks

📊 STATISTIC:

“Businesses with well-documented processes and clean financials sell 20–40% faster than those without.”

— Source: BizBuySell 2024 Business Sales Trends Report

💬 EXPERT QUOTE:

“The more prepared you are, the more confident buyers feel. Financial transparency and operational readiness are key to getting top dollar.”

— Laura Chen, Certified Business Broker (CBB), M&A Advisor

Key Takeaways

| Key Points | Solutions |

|---|---|

| Clean, clear financials build trust | Hire a CPA to prepare statements |

| Documented processes add value | Create SOPs for daily operations |

| Staff stability reassures buyers | Retain key team members |

| Legal readiness prevents delays | Audit licenses, permits, lease |

| Operational improvements attract offers | Update tech, fix issues, optimize |

| Prepared businesses sell faster | Start prepping 6–12 months before sale |

💰 Valuing Your MedSpa Accurately

Once your MedSpa is prepared, the next step is to accurately value the business.

Not sure how to value your MedSpa? You can start with our full step-by-step guide on how to value a MedSpa — it explains EBITDA, valuation multiples, and what buyers look for.

Why it matters:

👉 Price too high — your MedSpa won’t attract serious buyers

👉 Price too low — you leave money on the table

A well-supported valuation helps you negotiate confidently and justifies your asking price.

🔍 How to Calculate Value

Most MedSpa valuations are based on a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, Amortization).

Typical valuation formula:

👉 EBITDA x Valuation Multiple = Estimated Business Value

- EBITDA shows true earnings potential

- Multiple depends on factors like location, growth, client retention, assets, and market demand

Example:

$250,000 EBITDA x 4 multiple = $1 million valuation

In addition to EBITDA, tracking the right key performance indicators (KPIs) — such as revenue per client visit, client retention rate, and recurring revenue — helps strengthen your valuation. You can explore the top KPIs for MedSpa growth here to start improving your numbers before going to market.

📈 What Influences Valuation

✅ Revenue & Profitability

✅ Client retention rates

✅ Membership or recurring revenue models

✅ Equipment and technology

✅ Brand reputation & online presence

✅ Location & market trends

The more predictable and sustainable your earnings, the higher your potential valuation.

🧑💼 When to Hire a Valuation Expert

Many owners choose to work with:

✅ A Certified Valuation Analyst (CVA)

✅ An experienced business broker

✅ A CPA with M&A experience

Professionals can help you:

- Perform an objective valuation

- Benchmark against market comparables

- Provide supporting documentation for buyers and lenders

📊 STATISTIC:

“Businesses with professional valuations sell for 10–30% higher prices on average.”

— Source: International Business Brokers Association (IBBA) 2024 Trends Report

💬 EXPERT QUOTE:

“An accurate valuation gives you leverage in negotiations. It also helps attract serious buyers who understand the true value of your MedSpa.”

— Michael Reyes, CPA, Certified Valuation Analyst (CVA)

Key Takeaways

| Key Points | Solutions |

|---|---|

| Valuation sets the foundation for negotiation | Start with a clear EBITDA calculation |

| Most MedSpas sell based on EBITDA multiples | Work with a CPA or broker to assess |

| Client retention & recurring revenue add value | Focus on building memberships & loyalty |

| Professional valuations yield higher sale prices | Hire a certified valuation expert |

| Online reputation influences buyer interest | Invest in reviews & SEO before listing |

| Predictable earnings attract premium buyers | Stabilize revenue streams before sale |

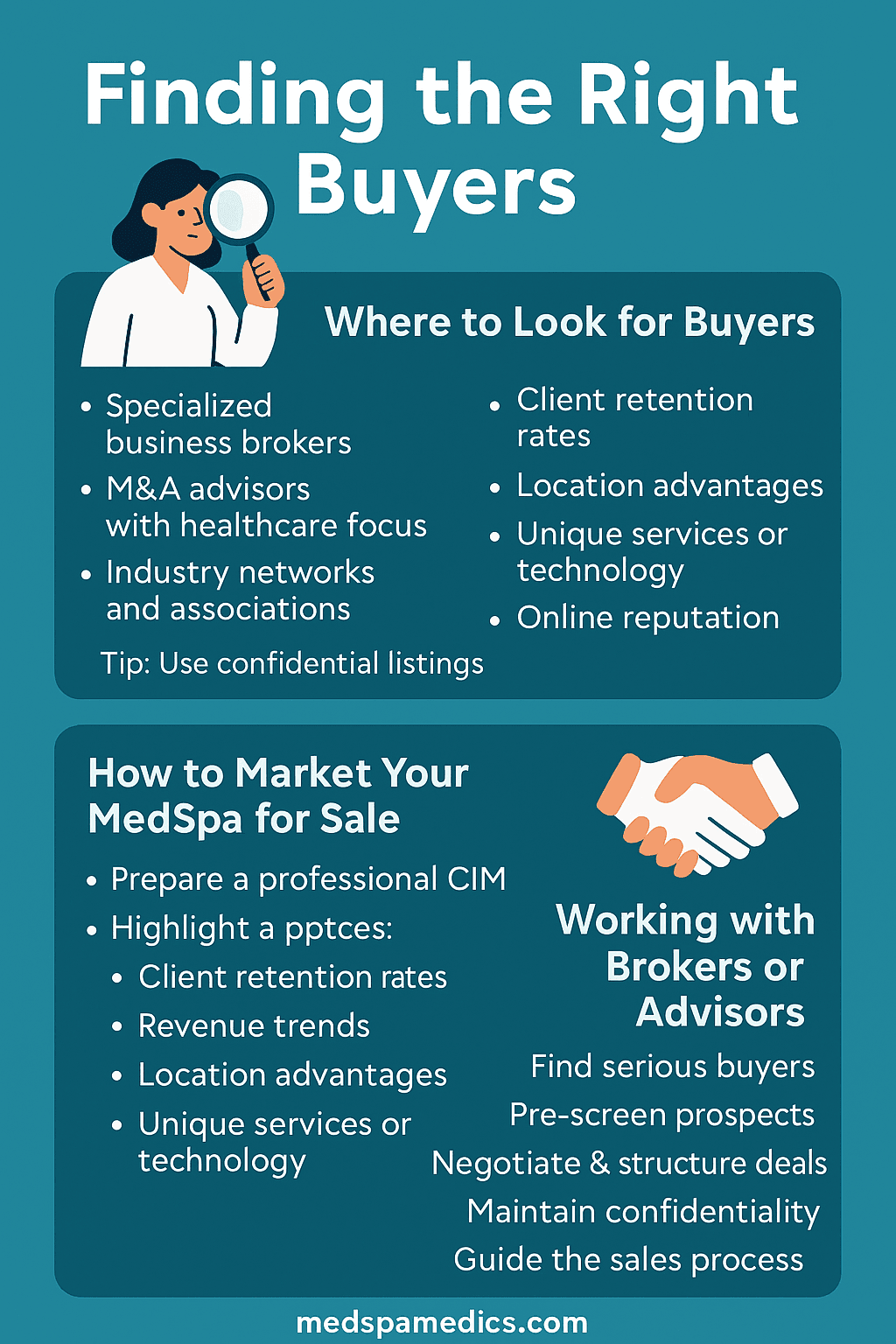

🕵️ Finding the Right Buyers

Once you know your MedSpa’s value, the next step is to find the right buyers — those who are serious, qualified, and a good fit for your business.

Not all buyers are the same. Some are corporate groups looking to roll up MedSpas. Others are individual investors or even fellow practitioners.

The key: Market your business strategically and know where to look.

👀 Where to Look for Buyers

✅ Specialized business brokers

✅ M&A advisors with healthcare focus

✅ Industry networks and associations (ex: AmSpa)

✅ Medical groups or private equity firms

✅ Competitors looking to expand

✅ Local investors or professionals

Tip: Use confidential listings — you don’t want to alarm staff or clients before the deal is secure.

📢 How to Market Your MedSpa for Sale

- Prepare a professional Confidential Information Memorandum (CIM)

→ Includes financials, operations, growth potential - Highlight your MedSpa’s strengths:

✅ Client retention rates

✅ Revenue trends

✅ Location advantages

✅ Unique services or technology

✅ Online reputation

A polished marketing package attracts better buyers and stronger offers.

🤝 Working with Brokers or Advisors

Pros of working with a broker or M&A advisor:

✅ They know where to find serious buyers

✅ They can pre-screen prospects

✅ They help negotiate and structure deals

✅ They maintain confidentiality

✅ They guide you through the sales process

Yes, they take a commission — but the right broker often helps you sell faster and for a higher price.

📊 STATISTIC:

“80% of business sales over $1 million involve a professional M&A advisor or broker.”

— Source: Pepperdine Private Capital Markets Project, 2024

💬 EXPERT QUOTE:

“An experienced broker opens doors to buyers you may never reach on your own — and knows how to position your MedSpa for maximum value.”

— Samantha Patel, M&A Healthcare Advisor

Key Takeaways

| Key Points | Solutions |

|---|---|

| Not all buyers are a good fit | Screen for serious, qualified prospects |

| Professional marketing materials attract offers | Prepare a Confidential Information Memorandum (CIM) |

| Brokers and M&A advisors open doors | Interview several before choosing one |

| Maintain confidentiality during marketing | Use blind listings and NDAs |

| Buyers look for growth potential | Highlight unique strengths and trends |

| Most $1M+ deals involve an advisor | Consider using a professional for higher-value sales |

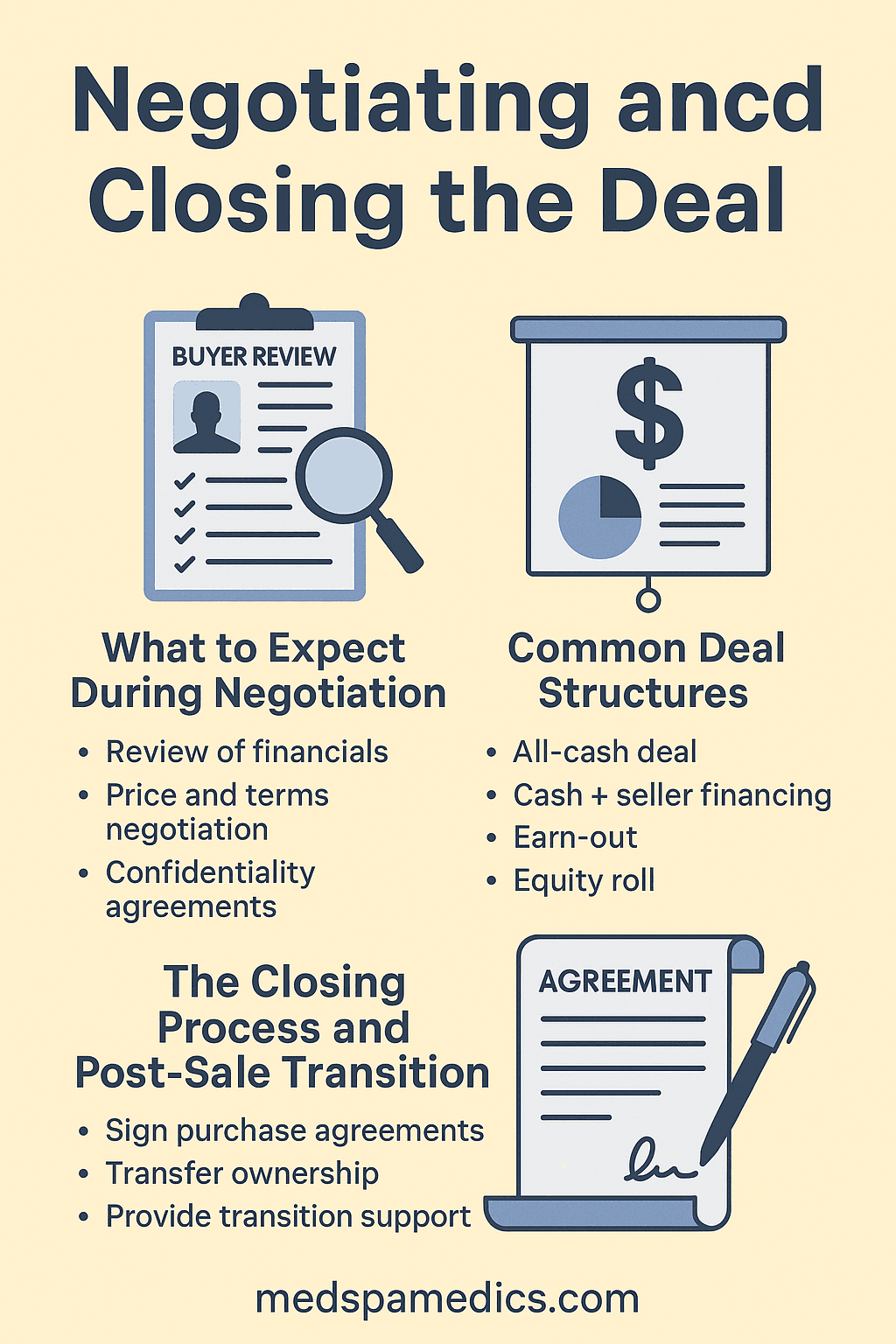

🤝 Negotiating and Closing the Deal

You’ve found the right buyer — now it’s time to negotiate and close the deal!

This phase can feel overwhelming for first-time sellers, but with good preparation and the right advisors, it can go smoothly.

💬 What to Expect During Negotiation

✅ The buyer will review your financials and perform due diligence

✅ They may request clarifications or adjustments

✅ Expect negotiation on price and terms

✅ Confidentiality agreements (NDAs) stay in place

Key negotiation points:

- Final sale price

- Deal structure (cash, seller financing, earn-outs)

- Transition support (will you stay on temporarily?)

- Asset vs. stock sale

📃 Common Deal Structures

1️⃣ All-Cash Deal:

- Full payment at closing

- Simple and clean — but rare for larger deals

2️⃣ Cash + Seller Financing:

- Buyer pays part up front, balance over time

- Helps bridge valuation gaps

3️⃣ Earn-Out:

- Additional payments based on future performance

- Protects buyer if revenue declines after sale

4️⃣ Equity Roll:

- Seller keeps a minority ownership stake post-sale

- Common in private equity deals

📝 The Closing Process and Post-Sale Transition

1️⃣ Sign Letter of Intent (LOI)

2️⃣ Conduct due diligence

3️⃣ Finalize purchase agreement

4️⃣ Close the deal → transfer ownership

5️⃣ Provide transition support (typically 30–90 days)

Post-sale:

✅ Communicate carefully with staff and clients

✅ Help ensure a smooth handoff to the new owner

✅ Celebrate your successful sale! 🎉

📊 STATISTIC:

“Deals with clear transition plans close 33% faster and experience higher post-sale client retention.”

— Source: Business Transition Academy, 2024

💬 EXPERT QUOTE:

“The best deals are win-win — when both seller and buyer feel supported through a clear, collaborative transition process.”

— Robert Blake, Business Attorney & M&A Specialist

Key Takeaways

| Key Points | Solutions |

|---|---|

| Due diligence is a standard step | Be transparent and organized |

| Negotiation covers more than price | Understand deal structures and terms |

| Seller financing can bridge gaps | Consider flexible deal options |

| Earn-outs protect both parties | Structure terms carefully |

| Post-sale transition impacts success | Plan for 30–90 days of support |

| Professional advisors guide you | Use a business attorney and broker |

Conclusion

Selling your MedSpa is a big decision — and a big opportunity. With the right preparation, valuation, marketing, and deal structure, you can maximize both the value of your business and the success of the transition.

Let’s recap the process:

✅ Prepare your MedSpa for sale → Financial cleanup, operational readiness, legal prep

✅ Value your MedSpa accurately → Know your EBITDA, key value drivers, and market comparables

✅ Find the right buyers → Leverage brokers, networks, and professional marketing materials

✅ Negotiate and close the deal → Understand deal structures and plan for a smooth post-sale transition

Remember — the earlier you start preparing, the better your outcome will be when it’s time to sell.

Whether you’re planning to sell in 1 year or 5 years, taking action now can dramatically increase your MedSpa’s value when opportunity knocks. 🚀

✅ Action Steps for Med Spa Owners

Here’s how to start preparing your MedSpa for a successful, profitable sale:

- 📊 Organize your financials

Work with a CPA to clean up books and calculate EBITDA. - 📝 Document your processes

Create SOPs for daily operations to show buyers a “turnkey” business. - ⚙️ Optimize operations

Update technology, improve client retention, and stabilize revenue. - 🔍 Understand your valuation

Consult a valuation expert or broker to get a market-based estimate. - 🤝 Build a buyer profile

Identify the ideal type of buyer for your MedSpa (corporate, investor, practitioner). - 📢 Create professional marketing materials

Prepare a polished CIM to showcase your MedSpa’s strengths. - 🧑💼 Assemble your advisory team

Engage a business broker, CPA, and attorney experienced in M&A. - 📅 Start early!

The more time you give yourself to prepare, the better your results will be.

Pro Tip: Many owners start preparing 12–24 months before listing to maximize valuation and build a stronger negotiation position.

FAQ: How to Sell Your MedSpa

1️⃣ When is the best time to sell my MedSpa?

Ideally when the business is growing, with stable revenue and strong retention. Buyers pay more for businesses with clear future potential.

2️⃣ How long does it take to sell a MedSpa?

It typically takes 6–12 months to prepare and sell a MedSpa, depending on market demand, business readiness, and buyer fit.

3️⃣ How much is my MedSpa worth?

Most MedSpas sell for 3x to 6x EBITDA, but many factors affect valuation — including client base, market trends, location, and brand reputation.

4️⃣ Do I need to tell my staff I’m selling?

Not during the early stages. Use confidential marketing and notify staff when the deal is finalized or close to closing — to ensure a smooth transition.

5️⃣ What documents will buyers want to see?

Buyers typically request:

- 3 years of financials

- Client retention and revenue data

- Lease and contracts

- Asset inventory

- Legal and compliance documentation

6️⃣ Should I hire a business broker?

For most MedSpas, especially those valued over $500K–$1M, a broker or M&A advisor is highly recommended — they can help you sell faster and for a better price.

7️⃣ How do earn-outs work in MedSpa sales?

An earn-out is when part of the sale price is paid based on future performance — for example, maintaining certain revenue targets for 12–24 months post-sale.

8️⃣ What can I do now to increase my MedSpa’s value?

Focus on improving profitability, retention rates, and recurring revenue — and start documenting everything clearly for potential buyers.

🚀 Ready to Maximize Your MedSpa’s Value Before You Sell?

The most successful MedSpa sales start with intentional growth — building value, profitability, and client loyalty BEFORE going to market.

👉 Book your FREE Growth Accelerator Session today:

https://medspamedics.com/growth-accelerator-session/

✅ Identify ways to boost revenue & retention

✅ Make your MedSpa more attractive to buyers

✅ Walk away with a custom growth action plan

→ Perfect for MedSpa owners thinking about selling in the next 1–3 years!